Newcrest takes a $5.8 billion slide

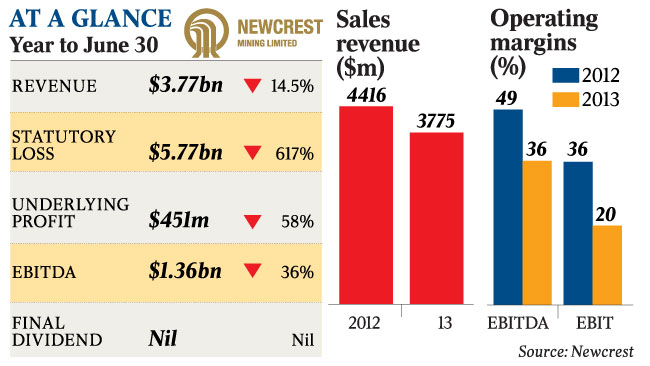

A raft bad luck and bad choices are catching up with one of Australia’s biggest mining firms, with reports Newcrest have posted s full-year loss of$5.8 billion.

The company has blamed a myriad of hindrances for their disappointing bottom line, Chief executive Greg Robinson said yesterday questions around disclosure practices, investigations by the corporate watchdog, two potential class actions and an internal investigation have shown the waning state of the company’s reputation on governance.

Newcrest’s total net loss for 2012-2013 was $5.778 billion, tumbling down from a $1.117 billion profit the year before.

“It's been a year of significant challenges, both in prevailing market conditions and within the company,” Mr Robinson said, “there is reputational damage about the other issues . . . the corrective actions around those will become apparent.”

Newcrest hopes its bold outlook will pay off next year, hoping to make its operations cash-flow positive or neutral at gold prices of $1450 an ounce, which is higher than recent prices. Gold stock prices have already helped the miner on the path to profitability this week.

Print

Print