Shareholders hold sway over Paladin Energy direction

The winds of change may sweep through uranium miner Paladin Energy’s executive board, helped-along by shareholders’ concerns.

The winds of change may sweep through uranium miner Paladin Energy’s executive board, helped-along by shareholders’ concerns.

A group of shareholders in the company has successfully called for a cut to the Paladin Energy chief executive’s payment, if he was to leave his position.

Paladin CEO John Borshoff was to receive a severance package of two times his base salary, calculated using the base salary he had earned in his last two years in the job – that entitlement has now been halved.

Reports say the changes were made both to appease angry stakeholders, and possibly to signal rapid or progressive shifts in Paladin’s leadership make-up.

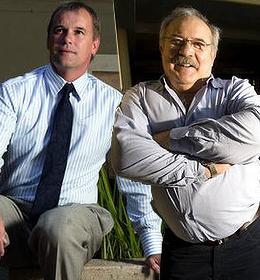

The company has been run by Mr Borshoff, with Rick Crabb as chairman, for almost 20 years. Mr Crabb has reportedly told industry media sources that “succession planning” is underway at Paladin.

Paladin Energy’s situation has been closely watched as an indicator of Australia’s potentially huge future uranium industry.

Extended maintenance shut-downs at some sites and a low international uranium price has left the company’s recent prospects looking less than golden.

The Australian Shareholders’ Association earlier this month called for the removal of chairman Rick Crabb, saying he could not bring his full efforts to the ailing company while he continues to hold chairmanships with three other groups.

Mr Crabb rejected the allegation.

Reports say advisory groups have recommended shareholders vote in favour of all motions at the annual meeting, including the re-election of Mr Crabb, but some insiders say they will not do so nor will they accept ratification of a dilutive share placement.

The vote is reportedly set to take place at a stakeholders meeting on November 21.

Print

Print